Understanding Mill Rates and Taxation

The City of St. John’s has a few different revenue streams, but most of our revenue comes from water and property tax - 64% in fact. The remaining 36% of our budget comes from user fees for programs and services (like the cost of swimming lessons or renting a facility), permits, fines, and government grants and subsidies.

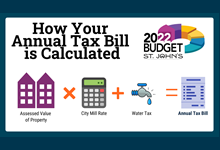

How is your tax bill calculated?

Although taxation affects us all differently, all property tax is calculated using the same method. To determine your tax bill, we multiply the assessed value of your property by the mill rate and add the water tax.

If the mill rate goes up in 2022, does it mean I’ll have a tax increase?

Not necessarily, no. In fact even if the mil rate increases, you could see a slight decrease in your tax bill.

In 2021, all properties in the City of St. John’s were assessed for the 2022 and 2023 tax years. In general, market values are down slightly in our municipality. This means that if the mill rate stayed the same in 2022 as 2021, the City would have a significant shortfall in revenue – about $3 million. This would have an impact on our ability to continue to provide the same level of service to our residents to property owners. We would have to consider cuts to service as the City of St. John’s, like all municipalities in our province, is required by law to present a balanced budget.

Currently, the residential property tax rate is set at 7.7 mills. 84% of residential properties in our city are valued at $400,000 or less. As an overall group, the assessed value of these properties has declined by about 5%. It is important to note, however, that there is a large variation in this group – it’s a lot of properties, and each home is assessed on multiple factors.

Let’s look at one hypothetical scenario Council is considering for residential properties. If Council increased the mill rate by from 7.7 mills to 8.3 mills in 2022:

- 30% of residential property owners would have no tax increase or a tax decrease in 2022

- 32% would have an increase of between .01 cent and $5 a month

- 12% would have an increase between $5 and $7.50 a month

- 7% would have an increase between $7.50 and $10 a month

- 19% would have an increase over $10 a month

Our plan for 2022 is to maintain levels of service and make small investments that will enhance the services that matter most to you, like snow clearing, and support our commitments to bolstering the economy and being a sustainable organization.

Where can I find out more about the budget engagement process?

All the feedback received is compiled in a What We Heard document on our engagement page. Visit engagestjohns.ca/budget-2022 to learn more.

When will the 2022 Budget be announced?

Budget day for the City of St. John's is December 13. Details will be posted on our website, or you can watch the debate at 3pm live at stjohns.ca/councilmeetings.